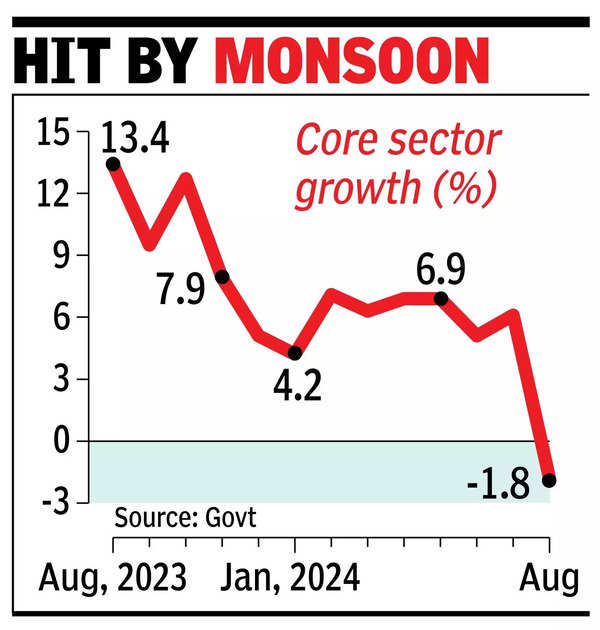

NEW DELHI: Output in the country’s key infrastructure sector contracted for the first time in over three years, led by a decline in six of the eight segments as excess monsoon rains impacted the performance, data showed on Monday.

Official data released by the commerce and industry ministry showed output in the sector spanning coal, crude oil, natural gas, refinery products, fertilisers, steel, cement, and electricity fell by 1.8% in Aug, compared to 6.1% in July.The sector had grown 13.4% in Aug last year.

The core sector accounts for nearly 40% of the index of industrial production and the latest data is expected to have an impact on the overall industrial output numbers, which will be released later this month. The sector had been growing at a healthy clip for past few months but impact of the weather has taken a toll.

Coal, crude oil, natural gas, refinery products, cement and electricity contracted during the month, dragging down the overall performance. Two sectors steel and fertilisers grew 4.5% and 3.2% during the month.

“Output of core industries posted a sombre 1.8% YoY contraction in Aug 2024, first instance of a decline in 42 months. Excess rainfall impacted mining activity, with output of coal, crude oil, and natural gas declining, while also leading to a contraction in electricity generation in the month. The decline in these sectors was accentuated by an elevated base, with a deficient rainfall in Aug 2023 supporting the output of these sectors in that month,” said Aditi Nayar, chief economist at Icra.

“Excess rainfall and an adverse base are also likely to have weighed upon the output of cement and steel sectors, with the former reporting a year-on-year contraction and the latter witnessing the slowest growth in 26 months. The performance of these sectors during July-August 2024 suggests that construction activity weakened in first two months of Q2 FY2025.

Separate data showed the country’s fiscal deficit stood at Rs 4.35 lakh crore or 27% of full year target at the end of Apr-Aug.